Are Office Supplies Taxable In Pa . A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. The information provided on this page is for informational purposes only and does not bind the department to any entity. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. The amount of ‘‘a’s’’ gross sales which is. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax unless such property.

from www.chegg.com

Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax unless such property. The amount of ‘‘a’s’’ gross sales which is. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. The information provided on this page is for informational purposes only and does not bind the department to any entity. A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance.

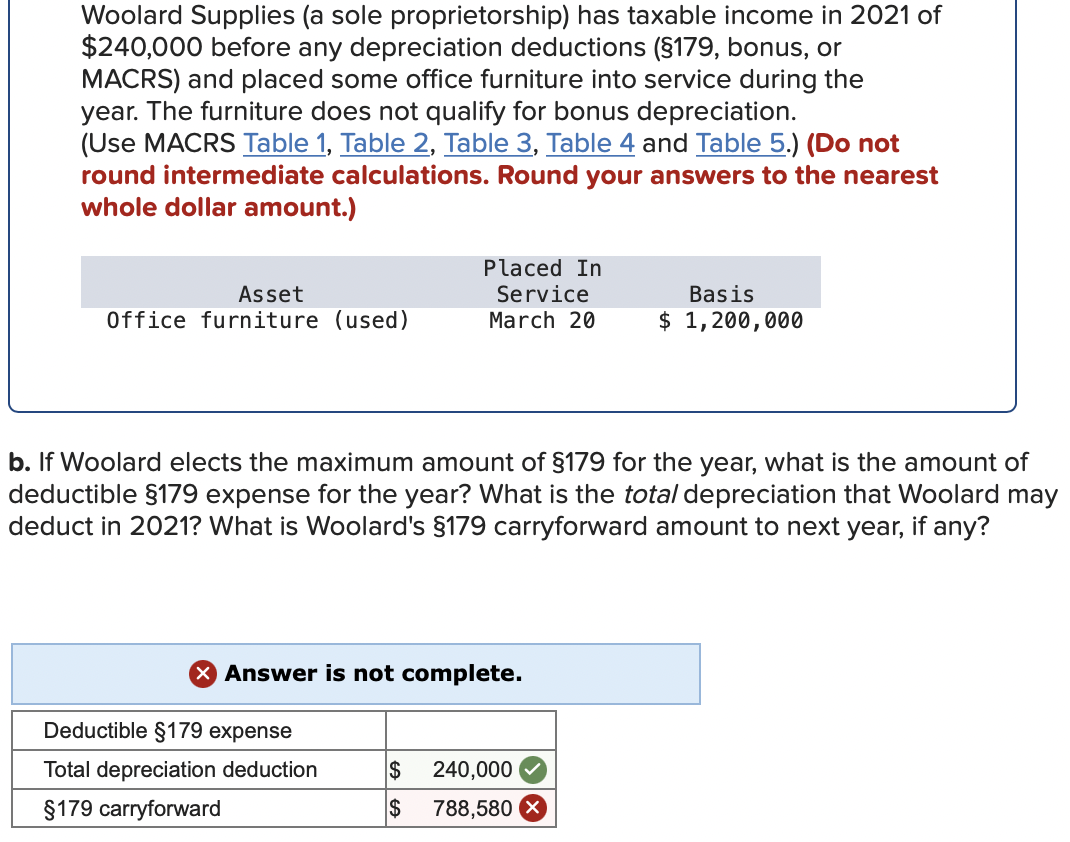

Solved Woolard Supplies (a sole proprietorship) has taxable

Are Office Supplies Taxable In Pa The amount of ‘‘a’s’’ gross sales which is. A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. The amount of ‘‘a’s’’ gross sales which is. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax unless such property. The information provided on this page is for informational purposes only and does not bind the department to any entity. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000.

From www.formsbirds.com

SUT Taxability of Dental Supplies List Free Download Are Office Supplies Taxable In Pa A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. The amount of ‘‘a’s’’ gross sales which is. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and. Are Office Supplies Taxable In Pa.

From www.signnow.com

Pa Tax Trust Inheritance Complete with ease airSlate SignNow Are Office Supplies Taxable In Pa The information provided on this page is for informational purposes only and does not bind the department to any entity. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax. Are Office Supplies Taxable In Pa.

From www.contactone.com.sg

Goods and Services Tax Should I Register? Are Office Supplies Taxable In Pa A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. The amount of ‘‘a’s’’ gross sales which is. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and. Are Office Supplies Taxable In Pa.

From www.chegg.com

Solved Woolard Supplies (a sole proprietorship) has taxable Are Office Supplies Taxable In Pa A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. The amount of ‘‘a’s’’ gross sales which is. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. The information provided on this page is for informational purposes only and does not bind the department to. Are Office Supplies Taxable In Pa.

From slidesdocs.com

Office Supplies Purchase Form Excel Template And Google Sheets File For Are Office Supplies Taxable In Pa In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax unless such property. The information provided on this page is for informational purposes only and does not bind the department. Are Office Supplies Taxable In Pa.

From www.aliexpress.com

[one Stop Purchase Of Office Supplies] Staff Enterprise Finance Office Are Office Supplies Taxable In Pa The information provided on this page is for informational purposes only and does not bind the department to any entity. A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax. Are Office Supplies Taxable In Pa.

From mungfali.com

Office Supplies Piedmont Office Supplies C81 Are Office Supplies Taxable In Pa The information provided on this page is for informational purposes only and does not bind the department to any entity. The amount of ‘‘a’s’’ gross sales which is. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and. Are Office Supplies Taxable In Pa.

From materialmagiccody.z4.web.core.windows.net

Publication 915 For 2020 Are Office Supplies Taxable In Pa A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. The amount of ‘‘a’s’’ gross sales which is. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and. Are Office Supplies Taxable In Pa.

From www.slideserve.com

PPT More Advanced VAT Partial Exemption Ian M Harris Leicester City Are Office Supplies Taxable In Pa The amount of ‘‘a’s’’ gross sales which is. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and. Are Office Supplies Taxable In Pa.

From www.pinterest.com

a blue poster with the words common deductible business expenies on it Are Office Supplies Taxable In Pa A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax unless such property. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000.. Are Office Supplies Taxable In Pa.

From www.etsy.com

Office Supplies Checklist, Business Office Supplies Checklist Template Are Office Supplies Taxable In Pa The amount of ‘‘a’s’’ gross sales which is. A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. The information provided on this page is for informational purposes only and does not bind the department to. Are Office Supplies Taxable In Pa.

From www.heritagechristiancollege.com

Free Office Supply List Template Of Fice Supplies Inventory Spreadsheet Are Office Supplies Taxable In Pa The information provided on this page is for informational purposes only and does not bind the department to any entity. Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax unless such property. A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions. Are Office Supplies Taxable In Pa.

From imojeanzallina.pages.dev

1040 Instructions 2024 Schedule A carte btp Are Office Supplies Taxable In Pa The information provided on this page is for informational purposes only and does not bind the department to any entity. The amount of ‘‘a’s’’ gross sales which is. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. Property used in waste handling and disposal of pollutants shall not be deemed to be. Are Office Supplies Taxable In Pa.

From www.chegg.com

Solved Woolard Supplies (a sole proprietorship) has taxable Are Office Supplies Taxable In Pa The amount of ‘‘a’s’’ gross sales which is. A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions and audit guidance. The information provided on this page is for informational purposes only and does not bind the department to any entity. Property used in waste handling and disposal of pollutants shall not be deemed to be. Are Office Supplies Taxable In Pa.

From www.chegg.com

Solved Woolard Supplies (a sole proprietorship) has taxable Are Office Supplies Taxable In Pa Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax unless such property. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net profit of $20,000. The amount of ‘‘a’s’’ gross sales which is. A guide for businesses needing straightforward answers to pennsylvania. Are Office Supplies Taxable In Pa.

From www.etsy.com

Office Supplies Request Printable Form Business Expense Etsy Are Office Supplies Taxable In Pa Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax unless such property. The information provided on this page is for informational purposes only and does not bind the department to any entity. In 1994, ‘‘a,’’ a sole proprietor, reported gross sales of $50,000 and a net. Are Office Supplies Taxable In Pa.

From www.dreamstime.com

On the Table are Business Charts, Office Supplies and a Notepad with Are Office Supplies Taxable In Pa Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax unless such property. The information provided on this page is for informational purposes only and does not bind the department to any entity. A guide for businesses needing straightforward answers to pennsylvania sales and use tax questions. Are Office Supplies Taxable In Pa.

From www.chegg.com

Solved Required information [The following information Are Office Supplies Taxable In Pa Property used in waste handling and disposal of pollutants shall not be deemed to be directly used and shall be subject to tax unless such property. The information provided on this page is for informational purposes only and does not bind the department to any entity. The amount of ‘‘a’s’’ gross sales which is. In 1994, ‘‘a,’’ a sole proprietor,. Are Office Supplies Taxable In Pa.